Empower Your Company: Bagley Risk Management Insights

Just How Livestock Risk Defense (LRP) Insurance Can Protect Your Animals Investment

Livestock Threat Protection (LRP) insurance stands as a dependable guard versus the uncertain nature of the market, providing a calculated method to protecting your possessions. By diving into the complexities of LRP insurance and its complex benefits, livestock manufacturers can strengthen their investments with a layer of protection that transcends market changes.

Understanding Animals Danger Protection (LRP) Insurance Coverage

Understanding Livestock Danger Defense (LRP) Insurance coverage is vital for animals manufacturers looking to alleviate economic threats related to cost changes. LRP is a federally subsidized insurance policy product created to safeguard producers versus a decrease in market value. By giving insurance coverage for market value decreases, LRP assists manufacturers lock in a flooring cost for their animals, guaranteeing a minimum degree of earnings regardless of market changes.

One key facet of LRP is its flexibility, enabling manufacturers to personalize protection levels and plan lengths to fit their specific needs. Manufacturers can choose the number of head, weight range, insurance coverage price, and insurance coverage duration that align with their manufacturing objectives and take the chance of tolerance. Recognizing these adjustable choices is critical for producers to efficiently handle their rate risk exposure.

In Addition, LRP is readily available for various animals kinds, including livestock, swine, and lamb, making it a functional threat management tool for livestock producers across various sectors. Bagley Risk Management. By acquainting themselves with the intricacies of LRP, producers can make educated choices to secure their investments and ensure economic security in the face of market unpredictabilities

Advantages of LRP Insurance for Animals Producers

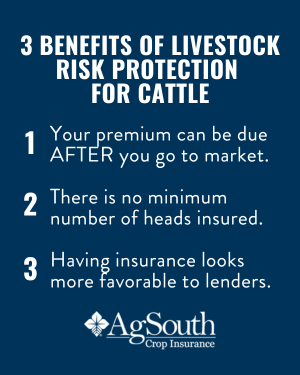

Animals manufacturers leveraging Animals Danger Security (LRP) Insurance policy gain a strategic advantage in protecting their financial investments from price volatility and safeguarding a stable economic footing amidst market uncertainties. By setting a floor on the rate of their animals, manufacturers can mitigate the risk of significant economic losses in the occasion of market declines.

Moreover, LRP Insurance policy gives manufacturers with peace of mind. On the whole, the benefits of LRP Insurance policy for livestock manufacturers are considerable, providing a valuable device for handling risk and making certain monetary safety and security in an unpredictable market setting.

Just How LRP Insurance Coverage Mitigates Market Risks

Alleviating market threats, Animals Threat Security (LRP) Insurance coverage supplies animals manufacturers with a trustworthy guard against cost volatility and economic unpredictabilities. By providing defense versus unanticipated rate drops, LRP Insurance coverage helps manufacturers secure their financial investments and preserve economic security when faced with market variations. This kind of insurance coverage permits animals manufacturers to secure a price for their animals at the beginning of the plan period, making sure a minimum price level regardless of market changes.

Actions to Safeguard Your Livestock Investment With LRP

In the world of agricultural risk monitoring, carrying out Animals Danger Protection (LRP) Insurance policy includes a critical procedure to secure investments versus market changes and uncertainties. To protect your livestock investment properly with LRP, the first step is to analyze the particular risks your operation faces, such as rate volatility or unanticipated climate events. Next off, it is essential to study and select a trusted insurance provider that provides LRP plans tailored to your animals and organization requirements.

Long-Term Financial Safety And Security With LRP Insurance Policy

Ensuring enduring monetary security with the use of Animals Risk Protection (LRP) Insurance is a prudent long-lasting technique for farming manufacturers. By integrating LRP Insurance policy right into their danger management plans, farmers can secure their livestock financial investments against unforeseen market fluctuations and adverse occasions that could jeopardize their financial health with time.

One key advantage of LRP Insurance coverage for lasting financial security is the comfort it provides. With a dependable insurance plan in place, farmers can mitigate the monetary risks connected with volatile market problems and unanticipated losses as a result of factors such as illness outbreaks or all-natural catastrophes - Bagley Risk Management. This security enables manufacturers to concentrate on the day-to-day operations of their animals company without continuous concern about possible financial troubles

In Addition, LRP Insurance gives an organized technique to handling danger over the long term. By establishing particular coverage levels and picking proper endorsement periods, farmers can customize their insurance plans to line up with their economic objectives and risk resistance, making sure a secure and lasting future for their livestock operations. Finally, investing in LRP Insurance coverage check that is a positive strategy for farming manufacturers to accomplish lasting economic protection and secure their incomes.

Final Thought

To conclude, Livestock Risk Security (LRP) Insurance is a valuable tool for livestock producers to alleviate market risks and secure their financial investments. this content By recognizing the advantages of LRP insurance and taking actions to implement it, manufacturers can attain long-lasting economic safety for their operations. LRP insurance coverage offers a safeguard versus price variations and makes certain a level of stability in an uncertain market setting. It is a wise selection for protecting livestock financial investments.